JUST KNOW! Why Are Taxes So High In Australia

OECD 2017 Tax revenue indicator. This is the fourth highest tax rate for spirits among the OECDs 33 member countries.

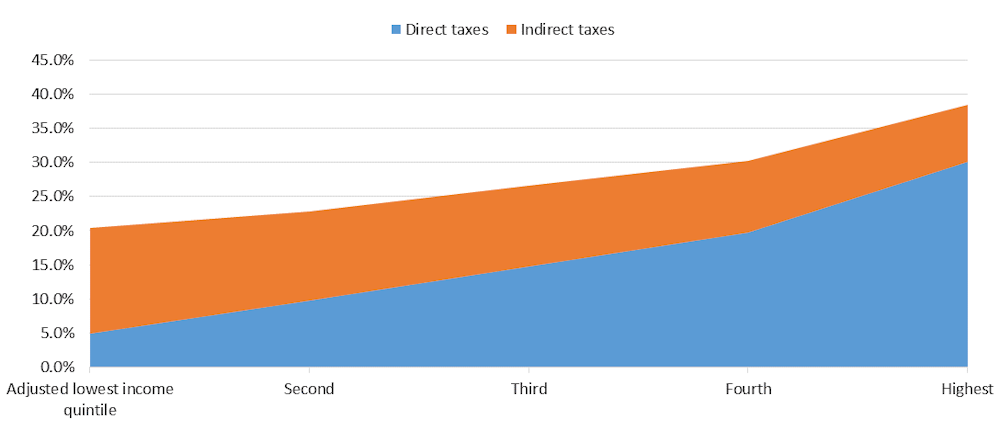

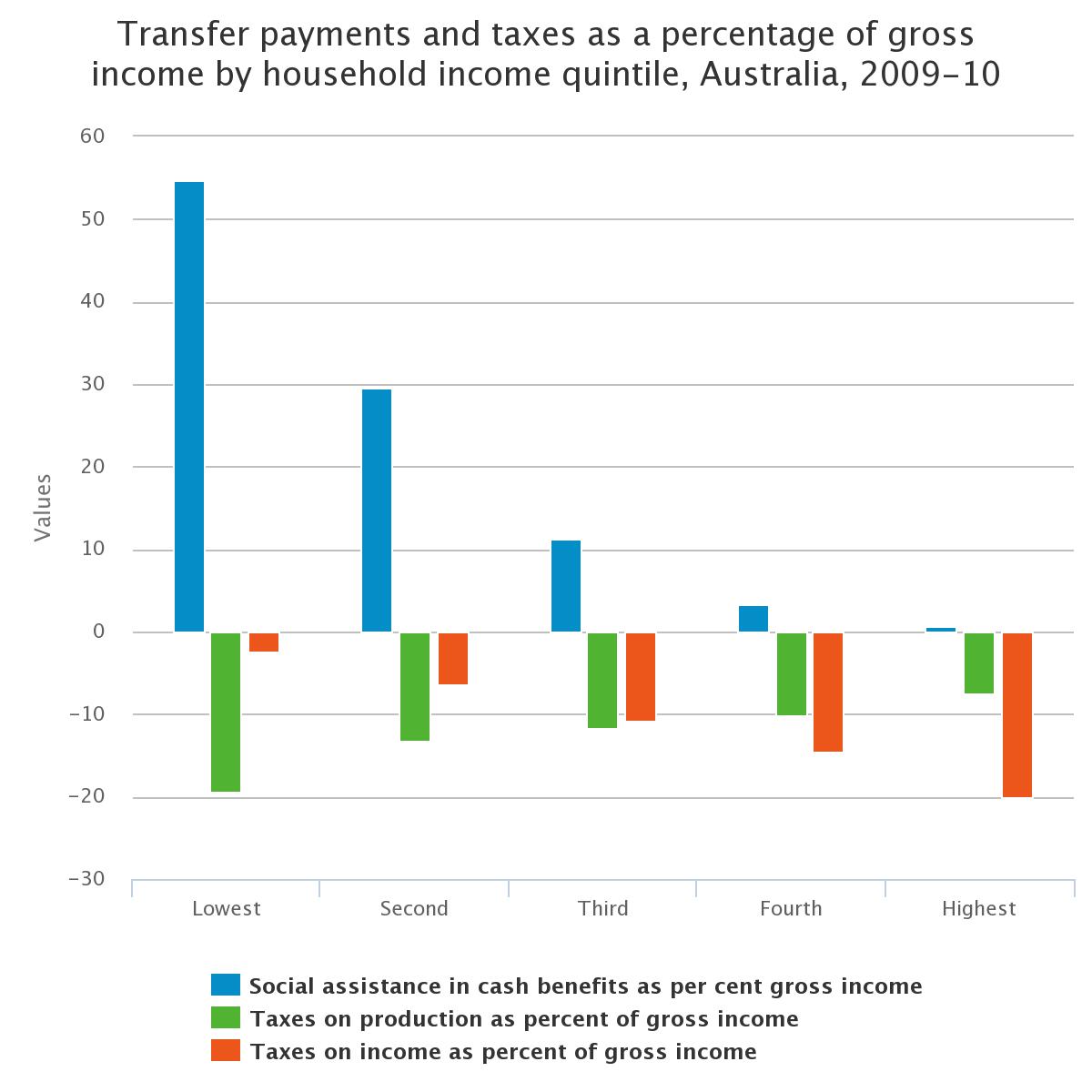

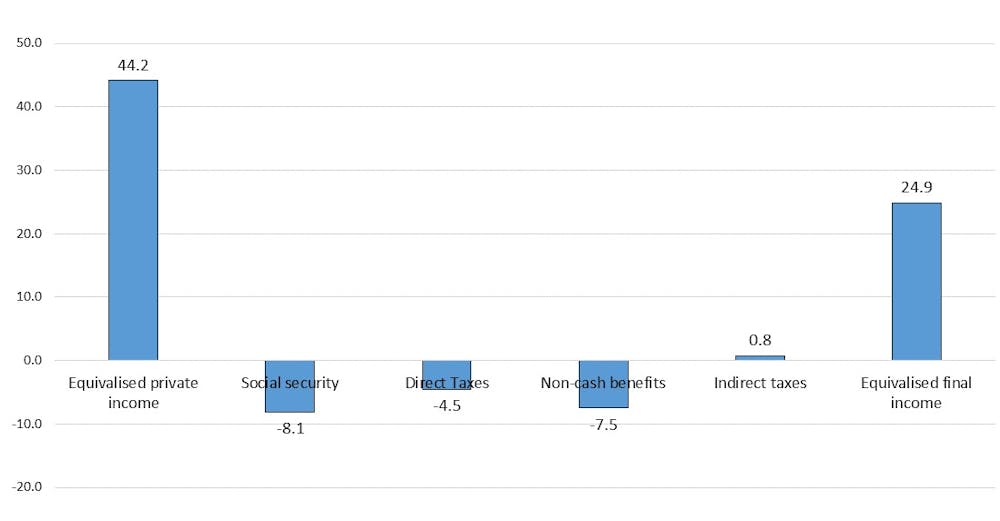

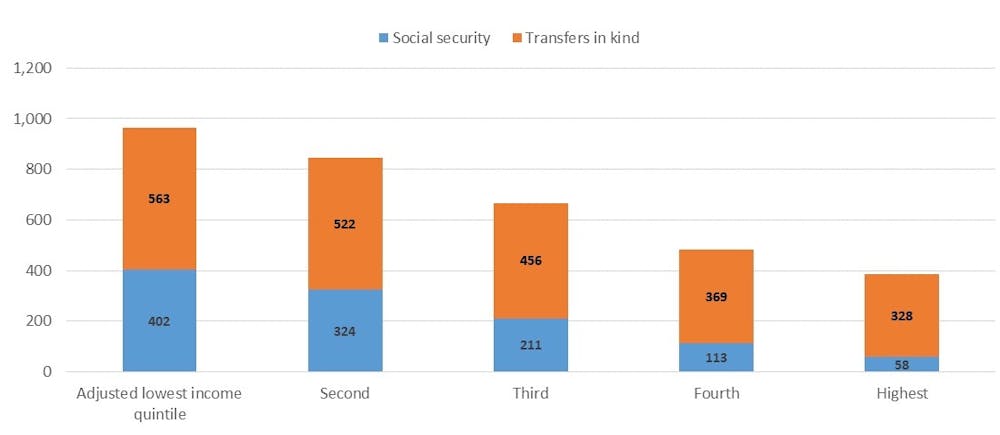

Who Gets What Who Pays For It How Incomes Taxes And Benefits Work Out For Australians

The ATO has processed more than 13 million tax refunds so far returning a total of 31 billion to Australians.

Why are taxes so high in australia. Not only that as it was paid at the same time as my normal monthly wage my monthly wage was also. There is the potential for significant health benefits for those who quit as well as. Historically tobacco products produced in Australia were subject to a lower rate of duty than that applicable to imported tobacco products.

And I can see why. My employer informed me prior to recieving the bonus how much the gross payment would be. This raises an important point about Australias corporate tax rate.

13 Coinciding with the end of the. So it comes as a shock to find out you have to pay tax to the government at the end of the year. Tax talk has been loud in Canberra as pollies clash over the Budget plan to increase the Medicare Levy by 05 per cent to 25 per cent a year and opposition parties want high income earners to.

Wine is taxed as a proportion of the wholesale price called the wine equalisation tax which means the tax applied to cask wine around 60 cents per litre. The smartest ways to spend your tax windfall. Answer 1 of 11.

It was 60 per cent in the early 1980s and it. Do people really ever stop work because the tax rate is too high. In keeping with reviews of available evidence in Australia2 29 30 and internationally31 Australias proposed tax increases are likely to lead to many smokers either decreasing their use or quitting altogether.

According to an analysis of countries around the world by Price Waterhouse Cooper Australia is ranked nearly at the top of tax rates for high-income earners. I just got a bonus from work. Australias top tax rate certainly keeps falling.

For example a unit trust may have a foreign trustee and CMC and so would not be an Australian tax resident for most purposes but if the unit trust owned property situated in Australia and Australian residents held more than 50 of the units the trust could be an Australian resident trust for CGT purposes. They pay 160 per cent rather than 96 per cent because Australia has a progressive income tax scale. How the barman is working for the taxman.

101787d98b8cf5-en Accessed on 26 October 2017 Both countries veer close to. So on average Australians pay about 3000 more than Americans a year. Take Home Rates for an annual income of 400000.

Equity concerns surrounding high tobacco taxes. The industry fund behemoth had net cash inflows of 84 billion last year enough to buy all the commercial property on the market in. Taxes in Canada are one of the biggest if not the biggest household expense for those with above average incomes.

Australia has both at the same time. In Australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates. Australia maintains a relatively low tax burden in.

Customs duty was brought into line with excise duty following the publication in June 1994 of a report of an inquiry by the Industry Commission into tobacco growing and manufacturing industries in Australia. Property taxes in Australia chiefly state stamp duty and land tax were about 10 per cent of tax revenue above the average of 58 per cent average. The average refund is 2381.

I know Im not the only one mystified by the case of the missing bonus so I reached out to CPA Lisa Greene-Lewis of TurboTax to find out why end-of-year bonuses seem to be taxed. When all forms of tax and. Australia has been able to keep its corporate tax rate so high in part because of.

For a start the Prime Minister is paid more than the president of USA and all the lower level politicians have voted enormous salaries for themselves too. While Australias drinking habits are changing per capita consumption of alcohol in 2013-14 dropped to 97 litres a 50-year low alcohol remains a lucrative earner for the government. In this video lets talk about how to reduce tax in Australia especially the taxes investing stocks in Australia.

By Jarrod Rogers CPA. So even if Australia had a completely flat tax a single rate with no tax-free threshold very highincome earners would still pay close to 10 per cent of all income taxes. But Australia also has the highest reliance on income and company tax in funding the overall tax take.

However those with low incomes and those with children often pay very little in taxes. The rate of tax paid increases as the taxpayers income. When state taxes are expressed as a share of the states economy Victoria is indeed the highest taxing state with taxes equivalent to 53 per cent of.

In fact according to statistics from 2009 84 of taxpayers received refunds and of the rest 4 had no tax to pay. For most taxpayers in Australia lodging a tax return means getting some money back from the government. Income taxes are the most significant form of taxation in Australia and collected by the federal government through the Australian Taxation OfficeAustralian GST revenue is collected by the Federal government and then paid to the states under a distribution formula determined by the Commonwealth Grants Commission.

Next you have the Social Welfare bill with 25 of the population receiving at least one gove. Expert coverage of Australias public sector. When I did get paid I found I had been taxed 44 instead of 31 as I am usually taxed on my monthly wage.

The ATO tax tables will help you work out the rates of tax you need to have withheld from your income from the sounds of it your employer has taxed you at 45 because you have claimed the exemption it would be a good idea to ask them why they have done this as that is not correct you may need to show them the tax tables. Check out this one on Austra. And that say some economists means we ought to restructure our tax system raising the GST.

Money And Wages In Australia Tax Info Australia Australian Money Working Holidays

Gst India Tax Taxation Vat Excise Servicetax Indirecttax Economy Business Finance Law Corporate Indirect Tax Economy Goods And Services

Even Though Im So Glad I Had The Opportunity To Live In France Australia And New York City And Even Though The Cost Of Living Is High New York City

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Who Gets What Who Pays For It How Incomes Taxes And Benefits Work Out For Australians

Is Australia A High Tax Country Australia Public Education Developing Country

Smoking Prevalence Following Tobacco Tax Increases In Australia Between 2001 And 2017 An Interrupted Time Series Analysis The Lancet Public Health

Want More Information Regarding Property Taxes And Other Property Investment Inquiries Co Rental Property Investment Investment Property Real Estate Investing

Experience Makes The Difference Accounting Services Online Bookkeeping Accounting

The Ultimate Guide On How To Write Good Essays Computer Programming Levels Of Education Good Essay

How Much Tax Do Aussies Pay Infographic Aussie Infographic Tax Time

Pin On Australia Business Stories

Who Gets What Who Pays For It How Incomes Taxes And Benefits Work Out For Australians

When Building A Business It S Extremely Important To Do So In A Field You Know Has A High Profit Margin High Prof Business Business Money Profitable Business

Reflective Chanel Airforce 1s In 2021 Nike Air Force Sneaker Chanel Air Force

Comments

Post a Comment