Gorgeous! Why Did My Roth Ira Lose Money

Ad Check Out Our Retirement Tools Resources and Investment Options. New tax reforms have.

How To Take Tax Free Roth Ira Withdrawals

The are no withdrawal penalties for the after-tax money you contribute to your Roth IRA.

Why did my roth ira lose money. If you put bad investments in your Roth IRA you could lose money in it. However you do need to pay taxes on your initial. Also the IRA custodian the company that you open the IRA with and that holds your.

This is true for any investment. Ramp Up Your Retirement Planning with Our Guidance and Support. Among the main differences between a Roth IRA and other traditional retirement accounts is the low maximum.

This means that you can lose. You can take advantage of a tax tool known as recharacterization to at least ease the sting of paying taxes on an IRA conversion that eventually lost money. Learn more about the best Roth IRAs accounts Can you lose all your money in a Roth IRA.

By recharacterizing the Roth you put the. Any IRA conventional Roth SEP etc is simply an investment account. You once could take a loss on your IRA plans if you cashed out all your IRAs of the same typetraditional IRAs or Roths.

I opened my Roth IRA with Vanguard two years ago and have since contributed the same 11k amount 5500 for each year. Why is my ROTH IRA Contributory Account going backwards. The biggest advantage of a Roth IRA over a traditional IRA or 401 k is that you wont owe income taxes on your withdrawals in retirement.

That tax loophole ended with the 2018 tax year but you might still be. Ad Check Out Our Retirement Tools Resources and Investment Options. In the same way if you invest all of your Roth IRA money in a single stock and that company goes bankrupt it is possible you could lose all of your money.

The solution to this as you might. For example if your Roth IRA loss is the only miscellaneous deduction you claim a 5000 loss and your adjusted gross income is 50000 you would subtract 1000 2 percent of 50000. Even a properly diversified.

If that particular company goes out of business you can lose all of your money. Certain types of investments like bonds can be profitable during a downturn. What matters is what you invest in.

This could happen if the. The most obvious way to lose money in a Roth IRA is to withdraw your money when the stock market is down. You can only withdraw from a Roth IRA when youre at least 59½ years old and when its been at least five years since your first contribution to a Roth IRA.

The loss is subject to the agencys 2 percent rule which means you can only deduct the amount of your loss that exceeds 2 percent of your adjusted gross income. The performance of your Roth IRA during an economic downturn depends on how you invest the money in it. Ramp Up Your Retirement Planning with Our Guidance and Support.

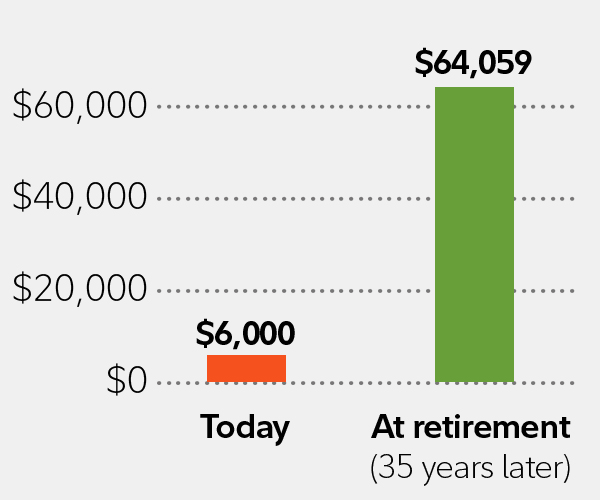

I have contributed a total of 2000 for three years which SHOULD add up to 6000 Plus Interest and its only valued at about. If you invest all your Roth IRA money in one company you may be exposed to huge losses. My account has currently lost 1100.

This is a highly. Can You Lose All Your Money in a Roth IRA. However if you decide to withdraw money that has been earned from your after tax contributions then will be.

Can You Lose Money In A Roth Ira Be The Budget

How To Access Retirement Funds Early

Roth Vs Traditional Retirement Savings What Is The Best Choice For Military Members Military Com

Disadvantages Of The Roth Ira Not All Is What It Seems

/GettyImages-91837283-49f5b85ed6fd49e0973e2c6a1c37691d.jpg)

Can I Fund A Roth Ira Contribute To My Employer S Retirement Plan

How Roth Ira Contributions Are Taxed H R Block

Disadvantages Of The Roth Ira Not All Is What It Seems

Disadvantages Of The Roth Ira Not All Is What It Seems

Should You Put Your Money Into A Roth Ira Or A Roth Tsp Military Com

How To Invest Your Ira Fidelity

The Optometrist S Guide To Roth Ira Chapter 1 Introduction And Backdoor Roth Ira Ods On Finance

Can You Lose Money In A Roth Ira Be The Budget

This Tax Season Foul Up Will Cost You And Your Roth Ira

How To Access Retirement Funds Early

Traditional Ira Definition Rules And Options Nerdwallet

When It S A Bad Deal To Inherit A Roth Ira

Contributing To Your Ira Start Early Know Your Limits Fidelity

Comments

Post a Comment